Mortgage Education

Managing Your Mortgage During COVID 19

This has been a trying time both emotionally and financially for many people who may have seen their income reduced or eliminated entirely as a result of the COVID 19 pandemic. Mortgages are often the largest bill you have to pay each month, and therefore can be...

Now There is Less to Stress About the Mortgage Stress Test

What Changes to the Minimum Mortgage Stress Test Rate Means to Potential Homebuyers Getting a mortgage in Canada is about to get a little bit easier when the Department of Finance’s criteria for mortgage approval (the mortgage stress test) changes in April. This is...

Get Your Mortgage Pre-Approval and Be Ready For The Spring Market in Burlington, Hamilton and Oakville

Why a Mortgage Pre-Approval is an Important First Step As the real estate market heats up in Burlington, Hamilton, and Oakville this spring, be prepared to see more homes for sale (inventory) but also more people looking to buy (competition). If you’re planning to...

The Advantage Beyond the Mortgage Close

How our team is committed to supporting our clients beyond the close of business As in any industry you will meet the good, the bad and the indifferent; and yes, that unfortunately does include the mortgage arena. However, when you meet a mortgage broker who truly...

Where Key Federal Parties Stand on Housing

Know more before you vote on Monday, October 21st There is no argument that this Canadian Federal Election is one of the most contentious in recent history. With arguably two key parties vying for control, the key issues that Canadians care about most are often left...

New Government Shared Equity Plan… What is the Risk?

The Government of Canada recently introduced an incentive program for first-time home buyers that has many people outside the industry wondering if it’s a good move to help the next generation get into a home, or if it doesn’t really quite fill the need. Essentially,...

The Pros & Cons of Co-Signing

When Qualifying for a Mortgage or Renewal is Just Out of Reach With stress tests and current home prices still out of reach, many Canadians are looking at co-signing in order to buy or re-finance their home. While this might not even be an option for some, for others...

January Mortgage Forecast

January Mortgage Forecast - 2018 was Stressful, but 2019 will be Hopeful Let’s just say it... last year sucked for those most vulnerable trying to get ahead in the home ownership game. Thanks to the newly introduced “stress test” and rising rates, both fixed and...

Changes to HELOC Rules Now In Effect

HELOC Home Equity Line of Credit The big banks have slowly and quietly introduced new regulations that could affect some 3.1 million Canadians with home equity line of credits. So what changes are we talking about here and how can it impact you? Well, for those...

Is a Reverse Mortgage Right for You?

By retirement, often the largest asset our clients own is their home and that often plays into their retirement strategy. Early in our relationship, we ask specific questions surrounding retirement and work with our clients to ensure we understand their short and...

Home Equity: Handling Life’s Unexpected Expenses

You have a savings account, have contributed to RESPs for your child’s education and have life insurance. Sometimes all the planning in the world can’t account for those unexpected major life costs. Let’s look at the pros and cons of using equity in your home can help...

The Mortgage Process: What exactly can you expect

The mortgage process can be stressful… ask anybody who’s gone through it once, twice or twelve times. It never gets easier, and now with the new financial rules and regulations in place, it seems to be even more daunting for people. Let’s change that! As a mortgage...

Required Documents Checklist

Satisfying the terms of your mortgage approval can be a daunting task and often stressful. Our team at HW Advantage provides you with the guidance you need to ensure you have everything in order to close without delay (as much as possible). That is the advantage of...

Stress Test Follow-up

Stress Test Review: Two Months In New Stress Test Regulations Changing the Housing Market What a crazy few months it's been in the mortgage arena. The newly launched B-20 Mortgage Stress Test shook things up as expected and is changing the landscape for buyers...

Home Ownership is Already Stressful Enough

New stress test regulations in place by January 1, 2018 It is no secret that Canada has some of the highest debt-ratios of all the G7 countries, so to combat this swing, The Office of the Superintendent of Financial Institutions (OSFI) has instituted changes ensuring...

Is Cheaper Better When It Comes To Your Mortgage

Your offer was accepted! You’ve just bought a new house!! So now is the time to shop for a mortgage, right? Wrong. The time to start shopping was when you decided to start searching for a new home. Understanding the financial implications and what you can actually...

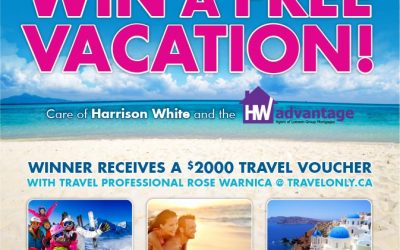

And the winner of the travel voucher is…

Watch as Harrison White announces the winner of the $2000 travel voucher from our Referral Program contest!

Self Employed Mortage? Why It’s Harder For You to Get One

Self Employed Mortgage: The Ins and Outs While self-employed professionals often have a harder time qualifying for a mortgage, it’s not impossible. Any person qualifying for a mortgage will have their application vetted based on the same 3 main principals. Income,...

Bank Traps to Avoid When looking for a Mortgage

Shopping for a mortgage: Whether you are buying a new home, refinancing, or renewing; spending the time and energy to obtain the best mortgage suited to your needs is extremely important. Banks often give the illusion that all you have to do is “get the best rate and...

Mortgage Broker: An advocate for borrowers

If you ask a mortgage broker “Why should I use a mortgage broker?” you had better clear your calendar for the rest of the day. A good mortgage broker knows and can clearly define the many benefits they can provide their clients. I for one am definitely passionate...