New stress test regulations in place by January 1, 2018 It is no secret that Canada has some of the highest debt-ratios of all the G7 countries, so to combat this swing, The Office of the Superintendent of Financial Institutions (OSFI) has instituted changes ensuring...

Mortgage Education Articles

Is Cheaper Better When It Comes To Your Mortgage

Your offer was accepted! You’ve just bought a new house!! So now is the time to shop for a mortgage, right? Wrong. The time to start shopping was when you decided to start searching for a new home. Understanding the financial implications and what you can actually...

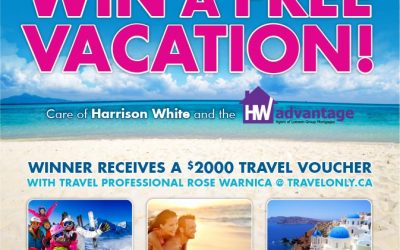

And the winner of the travel voucher is…

Watch as Harrison White announces the winner of the $2000 travel voucher from our Referral Program contest!

Self Employed Mortage? Why It’s Harder For You to Get One

Self Employed Mortgage: The Ins and Outs While self-employed professionals often have a harder time qualifying for a mortgage, it’s not impossible. Any person qualifying for a mortgage will have their application vetted based on the same 3 main principals. Income,...

Bank Traps to Avoid When looking for a Mortgage

Shopping for a mortgage: Whether you are buying a new home, refinancing, or renewing; spending the time and energy to obtain the best mortgage suited to your needs is extremely important. Banks often give the illusion that all you have to do is “get the best rate and...

Mortgage Broker: An advocate for borrowers

If you ask a mortgage broker “Why should I use a mortgage broker?” you had better clear your calendar for the rest of the day. A good mortgage broker knows and can clearly define the many benefits they can provide their clients. I for one am definitely passionate...

2016 in Review: This Past Year in Canadian Mortgage

2016 was quite a year in the Canadian mortgage industry! The first 9 months saw fixed rates dropping further to all-time lows (five-year fixed @ 2.29% at one point!) and in the meantime real estate prices continued to soar across most markets in Canada. In fact, it’s...

Debt Consolidation for Growth

Thinking about debt consolidation, renovations, using equity in your home for investment purposes, or just want to consider locking in to a lower interest rate? Many experts are saying that while rates are low, the time to lock in is now. We have already seen a slight...

Closing Costs!!!

While buying a home can be one of the most rewarding things you’ll ever do, it’s important that you are aware of the costs associated with this great experience. We’ve listed ten of the most common closing costs to keep in mind when buying a home. 1 Land transfer tax....

HW ADVANTAGE is hiring!

HW ADVANTAGE Job Posting: Customer Care and Marketing Advisor HW Advantage a member of the successful and highly regarded ‘Loewen Group’ Mortgage Brokerage located in Burlington, Ontario Canada is hiring! Reporting to the Director, the Customer Care and Marketing...

What is Bridge financing??

Bridge financing is most commonly required when someone purchases a new home at an earlier date then they sell their existing home. When that person needs the proceeds of their sale for down payment on the new purchase, the lender provides this additional financing to...

Mortgage Insurance v.s. Life Insurance

Here is a topic I get asked about quite often. People are shocked to know that Mortgage Insurance can actually be harmful to your financial health. Canadian Banks sell more Mortgage Insurance than all the big insurance companies combined. Although the banks are...